|

Thursday, March 19, 2009

Tracking economists' consensus on money illusion, as a proxy for Keynesianism

posted by

agnostic @ 3/19/2009 02:07:00 PM

I'm probably not the only person playing catch-up on economics in order to get a better sense of what the hell is going on. Just two economists clearly called the housing bubble and predicted the financial crisis, and only one of them has several books out on the topic -- Robert Shiller, the other being Nouriel Roubini. With Nobel Prize winner George Akerlof, Shiller recently co-authored Animal Spirits, a popular audience book making the case that human psychology and behavioral biases need to be taken into account when explaining any aspect of the economy, especially when things get all fucked up. That argument would seem superflous, but economics is the butt of "assume a can-opener" jokes for a reason.

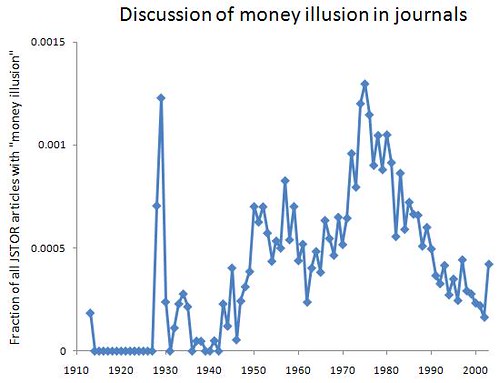

To be fair to the field, though, they point out that before roughly the 1970s, mainstream economists all believed that the foibles of human beings, as they really exist, should be incorporated into theory, rather than dismissing them as behaviors that only an irrational dupe would show. Remember that Adam Smith was a professor of moral philosophy and wrote extensively about human psychology. From what I can tell, the recent shift does not have to do with the introduction of math nerds into the field, since the man who laid most of the formal foundation -- Paul Samuelson -- was squarely in the "psychology counts" camp. It looks more like a subset of math nerds is responsible -- call them contemptuous autists, as in "What kind of idiot would engineer the brain that way?!" (Again, these are very rough impressions, and I'm winging it in categorizing people.) Of the many ideas relevant to understanding financial crises, a key one from the old school period is money illusion, or the idea that people think in terms of nominal rather than real prices. For example, if the nominal prices of things you buy go down by 20%, you won't be any better or worse off in real terms if your nominal wages also go down by 20%. However, most people don't think this way, and would see a 20% pay-cut in this context as a slap in the face, a breach of unspoken rules of fairness. This is an illusion because a dollar (or euro, or whatever) isn't a fixed unit of stuff -- what it measures changes with inflation or deflation. It's the same reason that women's clothing designers use fuzzy units of measurement -- "sizes" -- rather than units that we agree to fix forever, such as inches or centimeters. By artificially deflating the spectrum of sizes, a woman who used to wear a size 10 now wears a size 6, and she feels much better about herself, even if she has stayed the same objective size or perhaps even gotten fatter. How could they be so stupid to fall for this, when everyone knows it's a trick? Who knows, but they do. Similarly, everyone knows that inflation of prices exists, and yet the average person still falls victim to money illusion, and economic theory will just have to work that in, just as evolutionary theory must work in the presence of vestigial organs, sub-optimally designed parts, and other things that make engineers' toes curl. Animal Spirits provides an overview of the empirical research on this topic, and it looks like there's convincing evidence that people really do think this way. To take just one line of evidence, wages appear to be very resistant to moving downward, even when all sorts of other prices are declining, and interviews and surveys of employers reveal that they are afraid that wage cuts will demoralize or otherwise antagonize their employees. This is obviously a huge obstacle during an economic crisis, since firms will find it tough to hemorrhage less wealth by lowering wages -- even only by lowering them enough to match the now lower cost-of-living. The way Akerlof and Shiller present the history of the idea, it was mainstream before Milton Friedman and like-minded economists tore it down starting around 1967 and culminating by the end of the 1970s, although they hint that the idea may be seeing a rebirth. As an outsider, my first question is -- "is that true?" I searched JSTOR for "money illusion" and plotted over time the fraction of all articles in JSTOR that contain this term:  Although the term was coined earlier, the first appearance in JSTOR is a 1913 article by Irving Fisher, and the surge around 1928 - 1929 is due to commentary on his book titled Money Illusion. Academics were still talking about it somewhat through 1934, probably because the worst phase of the Great Depression spurred them to try to figure out what went wrong. The idea becomes more discussed during World War II, and especially afterwards when Keynesian thought swept throughout the academic and policy worlds within the developed countries. In the mid-'50s, the term decelerates and then declines in usage, although the policies of its believers are still in full swing. I interpret this as showing that from the end of WWII to the mid-'50s, their ideas were debated more and more, and after this point they considered the matter settled. Starting in the mid-late-1960s, though, the term begins to surge in usage to even greater heights than before, peaking in 1975, and plummeting afterward. This of course parallels the questioning of many of the ideas taken for granted during the Golden Age of American Capitalism, and the transition to Friedman-inspired thinking in academia and Thatcher-inspired thinking in public policy. Party affiliation clearly does not matter, since the mid-'40s to mid-'60s phase showed bipartisan support for Keynesian thinking, and after the mid-'70s there was also a bipartisan consensus on theory and policy applications. I interpret this second rise and fall as a re-ignited debate that was then considered a resolved matter -- only this time with the opposite conclusion as before, i.e. that "everyone knows" now that money illusion is irrational and therefore doesn't exist. The data end in 2003, since there's typically a five-year lag between the publication date of an article and its appearance in JSTOR. So, unfortunately I can't use this method to confirm or disconfirm Akerlof and Shiller's hints that the idea might be on its way to becoming mainstream in the near future. Whatever the empirical status of money illusion turns out to be -- and it does look like it's real -- the bigger question is whether or not economists will return to a serious, empirical consideration of psychology -- both the universal features (however seemingly irrational), as well as the individual differences that allow Milton Friedman to easily work through a 10-step-long chain of backwards induction, but not a typical working class person, who isn't smart enough to get into college (and these days, that's saying a lot). If all the positive press, not to mention book deals, that Shiller is getting are any sign, the forecast looks optimistic. Labels: Economics, intellectual history, politics, Psychology |