|

Thursday, January 21, 2010

What era are our intuitions about elites and business adapted to?

posted by

agnostic @ 1/21/2010 01:36:00 AM

Well, just the way I asked it, our gut feelings about the economically powerful are obviously not a product of hunter-gatherer life, given that such societies have minimal hierarchy, and so minimal disparities in power, material wealth, privileges of all kinds, etc. Hunter-gatherers don't even tolerate would-be elite-strivers, so beyond a blanket condemnation of trying to be a big-shot, they don't have the subtler attitudes that agricultural and industrial people do -- these latter groups tolerate and somewhat respect elites but resent and envy them at the same time.

So that leaves two major eras -- agricultural and industrial societies. I'm going to refer to these instead by terms that North, Wallis, & Weingast use in their excellent book Violence and Social Orders. Their framework for categorizing societies is based on how violence is controlled. In the primitive social order -- hunter-gatherer life -- there are no organizations that prevent violence, so homicide rates are the highest of all societies. At the next step up, limited-access social orders -- or "natural states" that sprung up with agriculture -- substantially reduce the level of violence by giving the violence specialists (strongmen, mafia dons, etc.) an incentive to not go to war all the time. Each strongman and his circle of cronies has a tacit agreement with the other strongmen -- who all make up a dominant coalition -- that I'll leave you to exploit the peasants living on your land if you leave me to exploit the peasants on my land. This way, the strongman doesn't have to work very much to live a comfortable life -- just steal what he wants from the peasants on his land, and protect them should violence break out. Why won't one strongman just raid another to get his land, peasants, food, and women? Because if this type of civil war breaks out, everyone's land gets ravaged, everyone's peasants can't produce much food, and so every strongman will lose their easy source of free goodies (rents). The members of the dominant coalition also agree to limit access to their circle, to limit people's ability to form organizations, etc. If they let anybody join their group, or form a rival coalition, their slice of the pie would shrink. And this is a Malthusian economy, so the pie isn't going to get much bigger within their lifetimes. So by restricting (though not closing off) access to the dominant coalition, each member maintains a pretty enjoyable size of the rents that they extract from the peasants. Why wouldn't those outside the dominant coalition not try to form their own rival group anyway? Because the strongmen of the area are already part of the dominant coalition -- only the relative wimps could try to stage a rebellion, and the strongmen would immediately and violently crush such an uprising. It's not that one faction of the coalition will never raid another, just that this will be rare and only when the target faction has lost some of its share in the balance of power -- maybe they had 5 strongmen but now only 1. Obviously the other factions aren't going to let that 1 strongman enjoy the rents that 5 were before, while they enjoy average rents -- they're going to raid him and take enough so that he's left with what seems his fair share. Aside from these rare instances, there will be a pretty stable peace. There may be opportunistic violence among peasants, like one drunk killing another in a tavern, but nothing like getting caught in a civil war. And they certainly won't be subject to the constant threat of being killed and their land burned in a pre-dawn raid by the neighboring tribe, as they would face in a stateless hunter-gatherer society. As a result, homicide rates are much lower in these natural states than in stateless societies. Above natural states are open-access orders, which characterize societies that have market economies and competitive politics. Here access to the elite is open to anyone who can prove themselves worthy -- it is not artificially restricted in order to preserve large rents for the incumbents. The pie can be made bigger with more people at the top, since you only get to the top in such societies by making and selling things that people want. Elite members compete against each other based on the quality and price of the goods and services they sell -- it's a mercantile elite -- rather than based on who is better at violence than the others. If the elites are flabby, upstarts can readily form their own organizations -- as opposed to not having the freedom to do so -- that, if better, will dethrone the incumbents. Since violence is no longer part of elite competition, homicide rates are the lowest of all types of societies. OK, now let's take a look at just two innate views that most people have about how the business world works or what economic elites are like, and see how these are adaptations to natural states rather than to the very new open-access orders (which have only existed in Western Europe since about 1850 or so). One is the conviction, common even among many businessmen, that market share matters more than making profits -- that being more popular trumps being more profitable. The other is most people's mistrust of companies that dominate their entire industry, like Microsoft in computers. First, the view that capturing more of the audience -- whether measured by the portion of all sales dollars that head your way or the portion of all consumers who come to you -- matters more than increasing revenues and decreasing costs -- boosting profits -- remains incredibly common. Thus we always hear about how a start-up must offer their stuff for free or nearly free in order to attract the largest crowd, and once they've got them locked in, make money off of them somehow -- by charging them later on, by selling the audience to advertisers, etc. This thinking was widespread during the dot-com bubble, and there was a neat management-oriented book written about it called The Myth of Market Share. Of course, that hasn't gone away since then, as everyone says that "providers of online content" can never charge their consumers. The business model must be to give away something cool for free, attract a huge group of followers, and sell this audience to advertisers. (I don't think most people believe that charging a subset for "premium content" is going to make them rich.) For example, here is Felix Salmon's reaction to the NYT's official statement that they're going to start charging for website access starting in 2011: Successful media companies go after audience first, and then watch revenues follow; failing ones alienate their audience in an attempt to maximize short-term revenues. Wrong. YouTube is the most popular provider of free media, but they haven't made jackshit four years after their founding. Ditto Wikipedia. The Wall Street Journal and Financial Times websites charge, and they're incredibly profitable -- and popular too (the WSJ has the highest newspaper circulation in the US, ousting USA Today). There is no such thing as "go after audiences" -- they must do that in a way that's profitable, not just in a way that makes them popular. If you could "watch revenues follow" by merely going after an audience, everyone would be billionaires. The NYT here seems to be voluntarily giving up on all its readers outside the US, who can’t be reasonably expected to have the ability or inclination to pay for web access. It had the opportunity to be a global newspaper, leveraging both the NYT and the IHT brands, and has now thrown that away for the sake of short-term revenues. This sums up the pre-industrial mindset perfectly: who cares about getting paid more and spending less, when what truly matters is owning a brand that is popular, influential, and celebrated and sucked up to? In a natural state, that is the non-violent path to success because you can only become a member of the dominant coalition by knowing the right in-members. They will require you to have a certain amount of influence, prestige, power, etc., in order to let you move up in rank. It doesn't matter if you nearly bankrupt yourself in the process of navigating these personalized patron-client networks because once you become popular and influential enough, you stand a good chance of being allowed into the dominant coalition and then coasting on rents for the rest of your life. Clearly that doesn't work in an open-access, competitive market economy where interactions are impersonal rather than crony-like. If you are popular and influential while paying no attention to costs and revenues, guess what -- there are more profit-focused competitors who can form rival companies and bulldoze over you right away. Again look at how spectacularly the WSJ has kicked the NYT's ass, not just in crude terms of circulation and dollars but also in terms of the quality of their website. They broadcast twice-daily video news summaries and a host of other briefer videos, offer thriving online forums, and on and on. Again, in the open-access societies, those who achieve elite status do so by competing on the margins of quality and price of their products. You deliver high-quality stuff at a low price while keeping your costs down, and you scoop up a large share of the market and obtain prestige and influence -- not the other way around. In fairness, not many practicing businessmen fall into this pre-industrial mindset because they won't be practicing for very long, just as businessmen who cried for a complete end to free trade would go under. It's mostly cultural commentators who preach the myth of market share, going with what their natural-state-adapted brain reflexively believes. Next, take the case of how much we fear companies that comes to dominate their industry. People freak out because they think the giant, having wiped out the competitors, will enjoy a carte blanche to exploit them in all sorts of ways -- higher prices, lower output, shoddier quality, etc. We demand the protector of the people to step in and do something about it -- bust them up, tie them down, resurrect their dead competitors, just something! That attitude is thoroughly irrational in an open-access society. Typically, the way you get that big is that you provided customers with stuff that they wanted at a low price and high quality. If you tried to sell people junk that they didn't want at a high price and terrible quality, guess how much of the market you will end up commanding. That's correct: zero. And even if such a company grew complacent and inertia set in, there's nothing to worry about in an open-access society because anyone is free to form their own rival organization to drive the sluggish incumbent out. The video game industry provides a clear example. Atari dominated the home system market in the late '70s and early '80s but couldn't adapt to changing tastes -- and were completely destroyed by newcomer Nintendo. But even Nintendo couldn't adapt to the changing tastes of the mid-'90s and early 2000s -- and were summarily dethroned by newcomer Sony. Of course, inertia set in at Sony and they have recently been displaced by -- Nintendo! It doesn't even have to be a newcomer, just someone who knows what people want and how to get it to them at a low price. There was no government intervention necessary to bust up Atari in the mid-'80s or Nintendo in the mid-90s or Sony in the mid-2000s. The open and competitive market process took care of everything. But think back to life in a natural state. If one faction obtained complete control over the dominant coalition, the ever so important balance of power would be lost. You the peasant would still be just as exploited as before -- same amount of food taken -- but now you're getting nothing in return. At least before, you got protection just in case the strongmen from other factions dared to invade your own master's land. Now that master serves no protective purpose. Before, you could construe the relationship as at least somewhat fair -- he benefited you and you benefited him. Now you're entirely his slave; or equivalently, he is no longer a partial but a 100% parasite. You can understand why minds that are adapted to natural states would find market domination by a single or even small handful of firms ominous. It is not possible to vote with your dollars and instantly boot out the market-dominator, so some other Really Strong Group must act on your behalf to do so. Why, the government is just such a group! Normal people will demand that vanquished competitors be restored, not out of compassion for those who they feel were unfairly driven out -- the public shed no tears for Netscape during the Microsoft antitrust trial -- but in order to restore a balance of power. That notion -- the healthy effect for us normal people of there being a balance of power -- is only appropriate to natural states, where one faction checks another, not to open-access societies where one firm can typically only drive another out of business by serving us better. By the way, this shows that the public choice view of antitrust law is wrong. The facts are that antitrust law in practice goes after harmless and beneficial giants, hamstringing their ability to serve consumers. There is little to no evidence that such beatdowns have boosted output that had been falling, lowered prices that had been rising, or improved quality that had been eroding. Typically the lawsuits are brought by the loser businesses who lost fair and square, and obviously the antitrust bureaucrats enjoy full employment by regularly going after businesses. But we live in a society with competitive politics and free elections. If voters truly did not approve of antitrust practices that beat up on corporate giants, we wouldn't see it -- the offenders would be driven out of office. And why is it that only one group of special interests gets the full support of bureaucrats -- that is, the loser businesses have influence with the government, while the winner business gets no respect. How can a marginal special interest group overpower an industry giant? It must be that all this is allowed to go on because voters approve of and even demand that these things happen -- we don't want Microsoft to grow too big or they will enslave us! This is a special case of what Bryan Caplan writes about in The Myth of the Rational Voter: where special interests succeed in buying off the government, it is only in areas where the public truly supports the special interests. For example, the public is largely in favor of steel tariffs if the American steel industry is suffering -- hey, we gotta help our brothers out! They are also in favor of subsidies to agribusiness -- if we didn't subsidize them, they couldn't provide us with any food! And those subsidies are popular even in states where farming is minimal. So, such policies are not the result of special interests hijacking the government and ramrodding through policies that citizens don't really want. In reality, it is just the ignorant public getting what it asked for. It seems useful when we look at the systematic biases that people have regarding economics and politics to bear in mind what political and economic life was like in the natural state stage of our history. Modern economics does not tell us about that environment but instead about the open-access environment. (Actually, there's a decent trace of it in Adam Smith's Theory of Moral Sentiments, which mentions cabals and factions almost as much as Machiavelli -- and he meant real factions, ones that would war against each other, not the domesticated parties we have today.) We obviously are not adapted to hunter-gatherer existence in these domains -- we would cut down the status-seekers or cast them out right away, rather than tolerate them and even work for them. At the same time, we evidently haven't had enough generations to adapt to markets and governments that are both open and competitive. That is certain to pull our intuitions in certain directions, particularly toward a distrust of market-dominating firms and toward advising businesses to pursue popularity and influence more than profitability, although I'm sure I could list others if I thought about it longer. Labels: Economic History, Economics, Evolutionary Psychology, History, politics, Psychology

Wednesday, December 02, 2009

Saturday, October 24, 2009

The other day I saw a flier for a colloquium in my department that sounded kind of interesting, but I thought "It probably won't be worth it," and I ended up not going. After all, anyone with an internet connection can find a cyber-colloquium to participate in -- and drawn from a much wider range of topics (and so, one that's more likely to really grab your interest), whose participants are drawn from a much wider range of people (and so, where you're more likely to find experts on the topic -- although also more know-nothings who follow crowds for the attention), and whose lines of thought can extend for much longer than an hour or so without fatiguing the participants.

So, this is something like the Pavarotti Effect of greater global connectedness: local opera singers are going to go out of business because consumers would rather listen to a CD of Pavarotti. It's only after it becomes cheap to find the Pavarottis and distribute their work on a global scale that this type of "creative destruction" will happen. Similarly, if in order to get whatever colloquia gave them, academics migrated to email discussion groups or -- god help you -- even a blog, a far smaller number of speakers will be in demand. Why spend an hour of your time reading and commenting on the ideas of someone you see as a mediocre thinker when you could read and comment on someone you see as a superstar? Sure, perceptions differ among the audience, so you could find two sustained online discussions that stood at opposite ends of an ideological spectrum -- say, biologists who want to see much more vs. much less fancy math enter the field. That will prevent one speaker from getting all the attention. But even here, there would be a small number of superstars within each camp, and most of the little guys who could've given a talk here or there before would not get their voices heard on the global stage. Just like the lousy local coffee shops that get displaced by Starbucks -- unlike the good locals that are robust to invasion -- they'd have to cater to a niche audience that preferred quirkiness over quality. So the big losers would be the producers of lower-quality ideas, and the winners would be the producers of higher-quality ideas as well as just about all consumers. Academics wear both of these hats, but many online discussion participants might only sit in and comment rather than give talks themselves. It seems more or less like a no-brainer, but will things actually unfold as above? I still have some doubts. The main assumption behind Schumpeter's notion of creative destruction is that the firms are competing and can either profit or get wiped out. If you find some fundamentally new and better way of doing something, you'll replace the old way, just as the car replaced the horse and buggy. If academic departments faced these pressures, the ones who made better decisions about whether to host colloquia or not would grow, while those who made poorer decisions would go under. But in general departments aren't going to go out of business -- no matter how low they may fall in prestige or intellectual output, relative to other departments, they'll still get funded by their university and other private and public sources. They have little incentive to ask whether it's a good use of money, time, and effort to host colloquia in general or even particular talks, and so these mostly pointless things can continue indefinitely. Do the people involved with colloquia already realize how mostly pointless they are? I think so. If the department leaders perceived an expected net benefit, then attendance would be mandatory -- at least partial attendance, like attending a certain percent of all hosted during a semester. You'd be free to allocate your partial attendance however you wanted, just like you're free to choose your elective courses when you're getting your degrees -- but you'd still have to take something. The way things are now, it's as though the department head told its students, "We have several of these things called elective classes, and you're encouraged to take as few or as many as you want, but you don't actually have to." Not exactly a ringing endorsement. You might counter that the department heads simply value making these choices entirely voluntary, rather than browbeat students and professors into attending. But again, mandatory courses and course loads contradict this in the case of students, and all manner of mandatory career enhancement activities contradict this in the case of professors (strangely, "faculty meetings" are rarely voluntary). Since they happily issue requirements elsewhere, it's hard to avoid the conclusion that even they don't see much point in sitting in on a colloquium. As they must know from first-hand experience, it's a better use of your time to join a discussion online or through email. The fact that colloquia are voluntary gives hope that, even though many may persist in wasting their time, others will be freed up to more effectively communicate on some topic. Think of how dismal the intellectual output was before the printing press made setting down and ingesting ideas cheaper, and before strong modern states made postage routes safer and thus cheaper to transmit ideas. You could only feed at the idea-trough of whoever happened to be physically near you, and you could only get feedback on your own ideas from whoever was nearby. Even if you were at a "good school" for what you did, that couldn't have substituted for interacting with the cream of the crop from across the globe. Now, you're easily able to break free from local mediocrity -- hey, they probably see you the same way! -- and find much better relationships online. Labels: academia, Economics, education, Technology

Wednesday, September 23, 2009

Antitrust suits are brought by busted businesses, not consumer crusaders: Dairy edition

posted by

agnostic @ 9/23/2009 10:22:00 PM

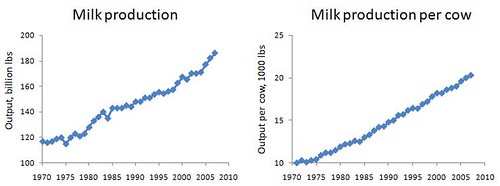

After reading Arthur De Vany's Hollywood Economics and Winners, Losers, and Microsoft by Stan Liebowitz and Stephen Margolis, I got the impression that antitrust cases on the whole have been misguided and often remarkably stupid. Looking a little more into it, I found that economists now are pretty much agreed on that picture. Here is the entry on antitrust from the Concise Encyclopedia of Economics, which has a nice brief list of references. Most cases are not brought by public representatives, whether elected or self-appointed, but by private companies, often rivals of the defendant who are being driven out of business. Businessmen believe that competition is good if they win but bad if the other guy wins. After reading Arthur De Vany's Hollywood Economics and Winners, Losers, and Microsoft by Stan Liebowitz and Stephen Margolis, I got the impression that antitrust cases on the whole have been misguided and often remarkably stupid. Looking a little more into it, I found that economists now are pretty much agreed on that picture. Here is the entry on antitrust from the Concise Encyclopedia of Economics, which has a nice brief list of references. Most cases are not brought by public representatives, whether elected or self-appointed, but by private companies, often rivals of the defendant who are being driven out of business. Businessmen believe that competition is good if they win but bad if the other guy wins.Because these facts are not widely known outside of economics circles, and because most of us learned bogus stories about Standard Oil, etc., in high school history class, I figured I'd illustrate them with a recent complaint about alleged anti-competitiveness in the dairy industry. The farmers on the losing side of the commercial contest claim one thing, but I show that the facts prove the opposite. First, here are free WSJ articles about the small farmers' complaints and a follow-up on the response of the DoJ's antitrust division. We can ignore the complaints of all the farmers quoted, as well as the talk from politicians in dairy states, because the very first sentence says that there is a "price-depressing glut of milk." A monopoly harms consumers by restricting output in order to shoot prices up -- think of a diamond company that owns almost all diamonds but only allows a tiny amount to get into circulation. So right away we see that there is the exact opposite of monopolistic practices in dairy -- there is a glut rather than a dearth of output, and prices are plummeting rather than soaring. Is the 2001 merger of two large dairy processors to "blame" for greater output and lower prices, as suggested by the complainers? No. The article doesn't provide a broader perspective, but I looked up data from the Statistical Abstract of the United States' agriculture tables. Here is the price of milk received by farmers from 1980 to 2009, both unadjusted and adjusted for inflation using the CPI:  There is clearly no change in the trend during or after 2001. The real price of milk has been falling at least since 1980, and in this decade it has actually slowed down -- it's "showing signs of stabilization," as we would hear in another context. The nominal price shows no trend up or down, just greater volatility starting around 1995. OK, what about output -- was the recent merger responsible for flooding the market? Let's have a look:  The left graph shows that output has been increasing steadily at least since 1970. The only somewhat recent change is that the increase appears to get faster around 1995, compared to its shallower rate from 1985 to 1995. Again we see no effect of the 2001 merger -- let alone a harmful downward one. The graph on the right shows the trend for milk cows' productivity, or output per cow: it too has been steadily increasing since at least 1970, probably due to some combination of better technology and selective breeding. Here there is no change whatsoever in the rate around 2001 -- it's basically linear after 1975. So we have greater output, lower prices, and greater productivity. What about having "too much" market share? The articles say that Dean Foods buys less than 15% of the nation's supply of raw fluid milk, which is hardly a concentration of the industry -- even if market concentration mattered per se (which it doesn't). It is a red herring that it has market shares closer to 70% or 80% in some regions -- it could not try to restrict output and thus raise prices in these regions anyway. Why not? If Dean Foods tried to gouge consumers in Michigan, anyone in Michigan could simply buy milk from a state where the supposed monopolistic gouging was absent, transport it to Michigan, and sell it below what the monopolist was charging. And -- boom -- just like that, competition neuters gouging. (Looking more generally, milk is a commodity like gold, so just imagine if Michigan residents were charged up the ass for gold, while Ohio residents weren't. You could get rich quick in Michigan by buying gold in Ohio and selling it in Michigan, low enough to undercut the monopolist but high enough to cover your costs. Since these get-rich-quick opportunities would quickly exhaust themselves and drive down the monopolist's prices, we don't expect to see such price-gouging even if the company did have an incredibly large market share.) But are the big bad companies even driving the little guy out of business? In my quick search, I didn't find data for this year, but a press release on the state of US agriculture in 2007 says that it's the middle-sized farms that are getting cleared out, suggesting greater specialization (like Wal-Marts co-existing with tiny local boutiques): The latest census figures show a continuation in the trend towards more small and very large farms and fewer mid-sized operations. Between 2002 and 2007, the number of farms with sales of less than $2,500 increased by 74,000. The number of farms with sales of more than $500,000 grew by 46,000 during the same period. Granted, this is for all farms, not just dairy farms, but I'd be surprised if the pattern were in the other direction for the subset of dairy farms. Again, even if it were, that might make us feel bad about small farmers going out of business, but it would not be evidence of monopoly, anti-competition, or whatever else. Output and productivity are going up, and prices are going down. It doesn't get any simpler than that. As the CEE antitrust entry notes, most lawsuits are brought by companies who are suppliers or buyers of the targeted company. That's what we have here, since Dean Foods buys milk from the embittered dairy farmers. The incentive to make it an antitrust suit is that they can win three times the damages than if they didn't. So the next time you hear about some company coming under antitrust scrutiny, just keep this big picture in mind. Pretty much all such cases are bogus. Rather than crusades in the consumers' interests, they are cowardly attempts by a loser to have the referee handicap the winner just as they're about to get knocked out. I encourage readers to look through some of the references in the CEE entry; it is quite illuminating to see how backwards the history of antitrust has been, and how baldly we were lied to in high school about Standard Oil and the rest.

Tuesday, September 22, 2009

I stumbled onto these data which show meat consumption in kilograms over the years for a range of nations. I was curious as to the relationship between meat consumption & GDP PPP per capita. My logic is that the more $ you have the more calories you'll purchase in form of flesh protein & fat. That being said, there's obviously a limit to how many calories you might want to purchase per day, so extra cost of meat for the wealthy would be in the form of quality (e.g., eating only Kobe beef). I took the 2002 data on meat consumption and plotted it against GDP PPP per capita from 2007. The relationship is rather straightforward.

The thick black line is a fit via loess. Here's a plot that's log-transformed:  OK, but what you want to do are the deviations from the trend line, right? If you're "Green" minded, the "naughty and the nice."

The Virgin Islands is entered like that in the data, so perhaps it is a data entry error.... Labels: Economics

Thursday, August 27, 2009

Web 2.0 party is over -- you're going to pay for the news again, and hopefully more

posted by

agnostic @ 8/27/2009 12:52:00 AM

Recently at my personal blog I've been focusing on the idiocy of Web 2.0's central strategy for growth, namely creating online networks or communities where costly participation is given away for free. (The profitable online papers charge, YouTube and Facebook still not profitable, and a more general round-up of the second dot-com bust.) The hope was that hosting a free party with an open bar would attract a large crowd, and that this in turn would lead to ever-increasing ad revenues. That business model was doomed to failure during the first dot-com boom, and it is just as doomed during the second one (Web 2.0). In the meantime, following this strategy leads to cultural output typical of attention whores rather than the output of inventors and creators with secure patronage.

I was delighted today to discover that all of this is about to change. It's still pretty hush-hush -- no "buzz in the blogosphere" -- as I've read a fair number of articles on the topic, yet none has mentioned the coming change, even if they've mentioned the change earlier in the year. Starting sometime this fall, online newspapers will finally start to charge for access to their sites, although who they charge, how much, and in what manner (yearly, per article, etc.), is entirely up to the individual papers, and we don't know what shape that will take just yet. The business model of Journalism Online, the group that's spearheading the change, says they're aiming to get revenues from the top 10% of readers by visit frequency. In any case, the point is that the era of unlimited free access to online journalism is dead. Journalism Online seems to be a central hub that readers will go through to get to the various member organizations' publications, perhaps the way college students go through their university library's website to get access to various journals. According to co-founder Leo Hindery (as I heard on Bloomberg TV today), there are over 600 papers on board, and you can bet that includes most or all of the big ones, as they provide the best quality and yet receive no money from users (other than the FT and WSJ). All of the customer's payments will be kept track of through this one site. I don't have much more detail to give, since the Journalism Online website lays it out succinctly. Go read through the business model section and the press section (the 31-page PDF listed under "Industry Reports" is the most detailed). This is the first nail in the coffin of Web 2.0, and once the other give-it-away internet companies see how profitable it is to actually -- gasp! -- charge for your product, they will wake up from their pipe dream of growing by attracting a big crowd and pushing ads. YouTube, Facebook, MySpace, perhaps other components of Google, Wikipedia -- they can either charge and profit or get shoved out of the market by those who are growing by charging. The winners will have more to invest in improving their products and maybe even funding their industry's equivalent of basic R&D, we'll see a cultural output that won't pander quite so much to the lowest common denominator to chase ad revenue, and best of all -- the quality newspapers, social networking sites, and so on, will continue to exist and grow rather than be claimed as further casualties of the moronic dot-com boom mentality. At last the internet is sobering up from its 15-year Bender of Free. Labels: Economics, Media, Technology

Tuesday, August 25, 2009

At the end of an otherwise good reflection in the WSJ on where Google can go from here, we read the following:

It would be foolish to predict that Google won't have another business success, of course. Microsoft managed to leverage its strength in PC operating systems into a stranglehold over the word-processing and spreadsheet applications. Stan Liebowitz and Stephen Margolis debunked this at least 10 years ago in their book Winners, Losers, and Microsoft, and probably earlier, though I can't recall which journal article it originally appeared in. Scroll down to Figure 8.18 at Liebowitz's website, which shows the market share of Excel and Word in the Macintosh vs. Windows markets. They conclude: Examination of Figure 8.18 reveals that Microsoft achieved very high market shares in the Macintosh market even while it was still struggling in the PC market. On average, Microsoft's market share was about forty to sixty percentage points higher in the Macintosh market than in the PC market in the 1988-1990 period. It wasn't until 1996 that Microsoft was able to equal in the PC market its success in the Macintosh market. These facts can be used to discredit a claim sometime heard that Microsoft only achieved success in applications because it owned the operating system, since Apple, not Microsoft, owned the Macintosh operating system and Microsoft actually competed with Apple products in these markets. Labels: Economics, Technology

Wednesday, August 19, 2009

The greater fool theory 1: A mostly verbal mathematical model

posted by

agnostic @ 8/19/2009 09:22:00 PM

Here is a brief description of the idea that price bubbles are caused by people buying something, not necessarily because they think it's worth anything, but because they think they can find an even greater fool to buy it at a higher price. This continues until no more such fools can be found, and this bust drives prices back down to what they were before the boom began.

I didn't see any references to mathematical models of the theory at Wikipedia or through Googling around a bit, so I made one up today at Starbucks since I didn't have anything to read to pass the time. Because I'm not an economist, I don't know how original it is, or how it compares with alternative models of the greater fool theory (if they exist). So, this is intended just as an exercise in modeling, explaining the model, and hopefully shedding some light on how the world works. I've kept most of the exposition straightforward and largely verbal, so that you don't need to know much math at all to understand what the model says and what its implications are. In part 1, I lay out the logic of the model and explain enough of it to show that it is capable of producing a single round of boom-and-bust for price hype. Part 2 will provide more mathematical detail about how the dynamics unfold, a phase plane analysis, and graphs of how the variables of interest would change over time, to better wrap your brain around what the model predicts. This is a dynamic model, or one that tracks how things change over time -- after all, we want to see how price, the number of fools, etc., evolves. It is made of several differential equations, and all these equations say is what causes something of interest to go up or go down over time. (You may recall that the sign of a derivative tells you whether a function is increasing or decreasing, and the magnitude says by how much.) I'll only explain what is absolutely necessary for the reader to see what's going on, with the less necessary math being confined to footnotes. First, we set up the basic picture before we write down equations. My version of the greater fool theory goes like this. There is a population of people, and during a price bubble they can fall into three mutually exclusive groups: suckers (S), who are susceptible to joining in on the bubble; investors (I), who currently own the speculative stuff (such as a home bought for speculation); and those who are retired from the bubble (R), who used to be investors but have gotten rid of their investment. And of course there is the price of the thing -- I model only the extra price that it enjoys due to hype (P), above its fundamental value, since this is the only component of price that changes radically during the bubble. I set the population to be fixed in size during the bubble, since growth or decline is negligible over the handful of years that the bubble lasts. I also set the amount of speculative stuff to be fixed, which is less general -- supply should shoot up to meet the rising demand during a bubble. So, this model is restricted to cases where you can't produce lots more of the stuff, relative to how much already exists, on the time-scale of the bubble's boom stage (say, 5 years or less). Or perhaps no more of it will be produced at all, such as video game consoles from decades ago that the original manufacturers will never bring back into production, but which nostalgic fans have taken to buying and selling speculatively (like NEC's TurboDuo). Last, the amount of stuff that each investor has is the same across all investors and stays constant -- say, if each investor always owned just one speculative home. At the start of the bubble, there is a certain number of early investors. In order to sell their stuff, they need to meet a sucker to sell it to. When they meet -- and I assume the two groups are moving around independently of each other -- there is a probability that the sale will be made. If they make a deal, the sucker is now an investor, and the former investor is now retired. In this model, retireds do not again become suckers -- they consider themselves lucky to have found a greater fool and stay out of the bubble for good afterward. That's the extent of how people change between groups. As for price hype, again I'm not an economist, so the exact formula may differ from what's standard. I take it to respond positively to demand -- namely, the number of suckers -- and that there is a multiplier that serves as a reality check. This reality check should be weak at the start when most non-investors are suckers, and should be strong near the end when most non-investors are retired. In other words, the price hype at the beginning is a near total distortion -- nearly 0% accurate -- whereas the price hype near the end is nearly 100% accurate. This will make more sense once we write down formulas. Now we get to the differential equations for how these things change. We write down one equation for each variable whose values we're tracking over time. I use apostrophes to denote the derivative with respect to time (i.e., rate of change): S' = -aSI Since suckers can only lose members (by turning into investors), there is only one term, and it shows how suckers decline (negative sign). Remember, retireds do not go back into the pool of potential buyers. And investors either make a sale and go into the retired group, or they sit on their stuff in hope of selling, so they never contribute to the growth of suckers. Thus, there is no growth term. The parameter a shows the probability that, when a sucker and an investor meet, the investor will transfer his stuff to the sucker. ("Parameter" is another word for "constant," in contrast to a variable that changes.) The reason we use the product of S and I is that this is essentially the rate at which the two groups encounter each other when they move around independently of each other. [1] I' = aSI - aSI = 0 Investors both grow and decline, so one term is positive and the other negative. They grow by having a sucker join their ranks, which as we saw above happens at rate aSI. However, each time that happens, the investor loses his stuff and becomes retired. That happens at the same rate, and the negative sign just shows that this causes I to decline. When we simplify, we get I' = 0 -- that is, the number of investors does not change over time. That makes sense because each bundle of stuff always has an owner, regardless of how it may change hands, somewhat like the game of hot potato. When something doesn't change, it is constant, so whenever we see I from now on, we'll know that this is just another parameter, not a variable that changes. In particular, it refers to the initial number of early investors who get the bubble going. R' = aSI Retireds never join the suckers again. And recall the mindset of a retired person -- they knew the stuff was junk and are glad to have gotten through the selling process, so they cannot be sold the stuff again to become investors once more. Thus, there is no way for them to lose numbers. They grow by former investors making a sale and becoming retired, which once again happens at rate aSI. Here's the neat thing: notice that S' + R' = -aSI + aSI = 0. The sum of the two derivatives equals zero, and since taking a derivative shows the distributive property, this also means that (S + R)' = 0. That is, the sum of suckers and retireds does not change over time. This makes sense since, if the number of investors stays constant, the leftovers -- suckers and retireds -- is constant, regardless of how each separate group grows or shrinks. We can take this further to note that S' + I' + R' = 0, which means (S + I + R)' = 0. That is, the combined size of all three groups does not change over time -- which is just what we claimed by keeping total population size constant. (Otherwise, each group would have birth and death terms, aside from the terms that show how their members switch between groups.) We'll call this constant total population size N. So, S + I + R = N. Now, I is just a constant, so we'll move it to the other side: S + R = N - I. We have two variables, S and R, but we just wrote an equation connecting them, so we can re-write one in terms of the other. I'll choose R, but it doesn't matter. So, R = N - I - S, and anywhere we see R, we can replace it with N - I - S. In other words, we've removed R from our focus -- we can always get it from knowing what the variable S is, as well as the two parameters N and I. That means the equation for R' only gives us redundant information, and we can ignore it. We can also ignore the I' equation, since it just tells us that I is constant, and we're only interested in things that change. So we're left with just the S' equation. Now we move on to the price hype formula and how it changes over time. First, the formula for price as a function of demand and the reality check, since hype is never totally irrational and at least tries to take stock of reality: P = bS(R / Rmax) = bS(R / (N - I)) Demand is driven by the number of suckers -- the ones who eventually want to get in on the bubble -- and the parameter b says how strongly demand responds to the number of suckers. The multiplier (R / Rmax) provides a reality check. If you landed from Mars and only knew the number of suckers, you would also want to know how many retireds there were -- if there were few retireds, that would tell you the bubble had only just begun, so that hype is likely to be high and to go even higher short-term. Thus, this filter should not let much of the demand information through. Indeed, when R is very low compared to Rmax, the multiplier is near 0. However, if you saw that there were many retireds, that would say the bubble was near its bust moment, and that the information from demand is very accurate by this point. Indeed, when R is near Rmax, the multiplier is near 1 and the filter lets just about all of the demand information through. What is Rmax? It is the value when no one is a sucker and everyone is retired, aside from the constant number of investors. Looking above at the equation S + R = N - I, we see that when there are no suckers, R = N - I. Now we need to find the differential equation for how P changes over time. Using the product rule for derivatives [2], we get: P' = (abI / (N - I)) * S(2S + I - N) Since a, b, I, and N - I are always positive, and since S is positive except for the very end of the bubble when it is 0, in the meantime, whether price hype shoots up or crashes down depends on whether the term 2S + I - N is positive or negative. It is positive and price hype grows when S exceeds (N - I) / 2, which is half the size of non-investors. It is negative and price hype declines when S is below (N - I) / 2. It is 0 and price hype momentarily stalls out when S is exactly (N - I) / 2. Because the bubble starts with all non-investors being suckers, S is initially N - I, which is greater than (N - I) / 2. So at first the price hype shoots up. However, remember that S only declines -- as more and more of the suckers are drawn into the bubble (some of whom may also make sales and become retireds), S will inevitably fall below (N - I) / 2 and price hype will start to contract. When S inevitably reaches 0 -- when all non-investors are out of the bubble for good -- then P = 0 (recall that P = bS(R / Rmax)). Moreover, at that time P' = 0 too. Thus, at the end, price hype has completely evaporated and it will stay that way. This is a single round of boom-and-bust for price hype. In this post, I've shown how some pretty simple "greater fool" dynamics can lead to a boom-and-bust pattern for price hype. You can quibble with all of the assumptions I've made, but the model shows that the greater fools theory is a viable explanation for price bubbles. I've relaxed some of the assumptions to see if it makes a difference, like making the decline of S be a saturating rather than linear function of S, and so far they don't seem to affect things qualitatively. A more realistic model would have P appear in the equation for S' -- that is, to have price hype affect the probability of making a sale. Or rather, the trend of prices (P' ) should affect sale probability -- if suckers see that price hype is increasing, they should want to get in on the bubble, and to stay put if price hype is dropping. Also, allowing retireds to re-enter the pool of suckers would be more general and would almost certainly lead to sustained cycles of boom-and-bust, rather than a single round. But that's for another slow afternoon. In part 2, I'll go into more mathematical detail about how we see what states this system is at rest in, and whether they are stable to disruptions or not. I'll look more at the formula for the maximum level of price hype, and interpret that in real-world terms in order to see what things will give us larger-amplitude bubbles. I'll provide a picture of the phase plane, which shows what the equilibrium points are, and how the variables will change in value on their way from their starting values to the final ones. I'll also have a couple of graphs showing how the number of suckers and retireds, and the amount of price hype, change over time. [1] Draw one person at random, and the chance that they're a sucker reflects S. Draw another one at random, and the chance that they're an investor reflects I, since the draws are independent. The chance of doing both is just the product of the two separate probabilities. [2] P' = (bS(R / Rmax))' = (b / (Rmax)) (S' * R + S * R') A little algebra, which you can confirm by hand or using Maple, gives the equation in the main body for P'. Labels: Behavioral Economics, Economics, mathematics, Modeling

Wednesday, July 15, 2009

How soon businesses forget how loony the loony ideas of yesterday were

posted by

agnostic @ 7/15/2009 10:37:00 PM

Mathematical models of contagious diseases usually look at how people flow between three categories: Susceptible, Infected, and Recovered. In some of these models, the immunity of the Recovered class may become lost over time, putting them back into the Susceptible class. This means that if an epidemic flares up and dies down, it may do so again. If we treat irrational exuberance as contagious, then we can have something like a recurring exuberant-then-gloomy cycle within people's minds. That is, people start out not having strong opinions either way, they get pumped up by hype, then they panic when they figure out that the hype had no solid basis -- but over time, they might forget that lesson and become ripe for infection once more.

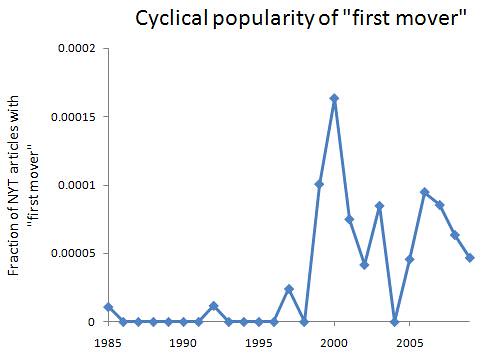

I'm in the middle of Stan Liebowitz's excellent post-mortem of the dot-com crash, Re-thinking the Network Economy, and in Chapter 3 he reviews the "first mover wins" craze during the tech bubble. According to this idea, largely transplanted into the business world from economists who'd already spread the myth of QWERTY, the prospect of lock-in was so likely -- even if newcomers had a superior product -- that it paid to rush your product to the market first in order to get the snowball inevitably rolling, no matter its quality. The idea was bogus, of course, as everyone learned afterward. (There were plenty of examples available during the bubble, but the exuberance prevents people from seeing them -- Betamax was before VHS, WordPerfect was before Microsoft Word, Sega Genesis was before Super Nintendo, etc. And there were first-movers who won, if their products were highly rated. So, when you enter doesn't matter, although quality of product does.) But when I looked up data on how much the media bought into this idea, I was surprised (though not shocked) to see that it was resurrected during the recent housing bubble, although it has been declining since the start of the bust phase. Below the fold are graphs as well as some good representative quotes over the years. First, here are two graphs showing the popularity of the idea in the mainstream media. The first is from the NYT and controls for the overall number of articles in a given year. (I excluded a few articles that use "first mover" in reference to the Prime Mover god concept in theology.) I don't have the total number of articles for the WSJ, so those are raw counts. Still, the pattern is exactly the same for both, and it very suggestively reflects the two recent bubbles:   The first epidemic is easy enough to understand -- after languishing in academia during the mid-1980s through the mid-1990s, the ideas of path dependence, lock-in, and first-mover advantage caught on among the business world with the surge of the tech bubble. When it became apparent that the dot-coms weren't as solid as was believed (to put it lightly), everyone realized how phony the theory supporting the bubble had been. Here's a typical remark from 2001: WHEN they were not promoting the now-laughable myth of ''first mover advantage,'' early e-commerce proponents proffered the idea that self-service Web sites could essentially run themselves, with little or no overhead. But clear-headedness eventually wears off, and when another bubble comes along, we can't help but feel exuberant again and take another swig of the stuff that made us feel all tingly inside before. Here's a nugget of wisdom from 2006: Media chieftains may be kicking themselves a few years from now because they didn't step up to pay whatever it took to own the emergent first mover in online video.And a similar non-derogatory, non-ironic use of the phrase from 2007: For the current generation of Internet applications, sometimes referred to as "Web 2.0," the data collected from users is the true source of competitive advantage. And the first movers, the companies that understand and apply this insight, have services that get better fast enough that their competition never catches up. Thankfully we've been hearing less and less of this stupid idea ever since the housing bubble peaked, and at least the most recent peak was lower than the first one, but we can still expect to hear something like this during whatever the next bubble is. Note that the first-mover-wins idea wasn't even being applied primarily to real estate during the housing bubble -- the exuberance in one domain carried over into a completely unrelated domain where it had flourished before. So, if you're at all involved in the tech industry, be very wary during the next bubble of claims that "first mover wins" -- it wasn't true then (or then, or then), and it won't be true now. Labels: Economics, History, Technology

Monday, July 13, 2009

QWERTY-nomics debate thriving 20 years after "The Fable of the Keys"

posted by

agnostic @ 7/13/2009 02:05:00 AM

In 1990, Stan Liebowitz and Stephen Margolis wrote an article detailing the history of the now standard QWERTY keyboard layout vs. its main competitor, the Dvorak Simplified Keyboard. (Read it here for free, and read through the rest of Liebowitz's articles at his homepage.) In brief, the greatest results in favor of the DSK came from a study that was never officially published and that was headed by none other than Dvorak himself. Later, when researchers tried to devise more controlled experiments, the supposed superiority of the DSK mostly evaporated.

Professional typists may have enjoyed about a 5% faster rate, or maybe not -- despite the conviction of the claims you hear, this isn't a well established body of evidence, such as "smarter people have faster reaction times." Moreover, most keyboard users aren't professional typists, and the vast bulk of their lost time is due to thinking about what they want to say. Therefore, the standardization of the QWERTY layout is not an example of our being locked in to an inferior technology. Which isn't to say that the QWERTY layout is the best imaginable -- but certainly not a clearly inferior layout compared to the DSK. While Liebowitz and Margolis may have hoped that their examination of the evidence would have thrown some cold water on the "lock-in to inferior standards" craze that had gotten going in the mid 1980s, with QWERTY as the proponents favorite example, the idea appears too appealing to academics to die. (Read this 1995 article for a similar debunking of Betamax's alleged superiority over the VHS format.) Liebowitz appeared on a podcast show just this May having to reiterate again that the standard story of QWERTY is bogus. To investigate, I did an advance search of JSTOR's economics journals for "QWERTY" and divided this count by the total number of articles. This was done for five four-year periods because it's not incredibly popular in any year, and that creates more noise in a year-by-year picture. I excluded the post-2004 period since there's typically a 5-year lag between publication and archiving in JSTOR. This doesn't show what the author's take is -- only how in-the-air the topic is. With the two major examples having been shown to not be examples of inferior lock-in at all, you'd think the pattern would be a flaring up and then dying down as economists were made aware of the evidence, and everyone can just leave it at that. But nope:  Note that the articles here aren't the broad class discussing various types of path dependence or network effects, but specifically the kind that lead to inferior lock-in -- as signalled by the mention of QWERTY. I attribute the locking in of this inferior idea to the fact that academia is not incentivized in a way that rewards truth, at least in the social sciences. Look at how long psychoanalysis and Marxism were taken seriously before they started to die off in the 1990s. Shielded from the dynamics of survival-of-the-fittest, all manner of silly ideas can catch on and become endemic. In this case, the enduring popularity of the idea is accounted for by the Microsoft-hating religion of most academics and of geeks outside the universities. For them, Microsoft is not a company that introduced the best word processors and spreadsheets to date, and that is largely responsible for driving down software prices, but instead a folk devil upon which the cult projects whatever evil forces it can dream up. Psychologically, though, it's pretty tough to just make shit up like that. It's easier to give it the veneer of science -- and that's just what the ideas behind the QWERTY and Betamax examples were able to give them. Overall, Liebowitz's work seems pretty insightful. There's very little abstract theorizing, which modeling nerds like me may miss, but someone's got to take a hard-nosed look at what all the evidence says in support of one model or some other. He and Margolis recognized how empirically unmoored the inferior lock-in literature was early on, and they also saw how dangerous it had become when it was used against Microsoft in the antitrust case. [1] He also foresaw how irrational the tech bubble was, losing much money by shorting the tech stocks far too early in the bubble, and he co-wrote an article in the late 1990s that predicted The Homeownership Society would backfire on the poor and minorities it was supposed to help. (Read his recent article on the mortgage meltdown, Anatomy of a Train Wreck.) Finally, one of his more recent articles looks at how file sharing has hurt CD sales. Basically, he details everything that a Linux penguin shirt-wearer doesn't want to hear. [1] Their book Winners, Losers, and Microsoft and their collection of essays The Economics of QWERTY attack the idea from another direction -- showing how the supposed conditions for lock-in or market tipping were met, and yet time and again there was turnover rather than lock-in, with each successive winner having received the highest praise. Labels: culture, Economics, History, Technology

Sunday, July 12, 2009

Robert Frank is promoting his idea that Charles Darwin will become more important than Adam Smith as an intellectual forebear of future economics in The New York Times. That is fine as it goes but I suspect that the bigger issue in the sciences of humanity is that there will be problems with relying on only one disciplinary framework and one general model. For example Frank points out that evolutionary fitness is generally conceived of in a relative sense (population mean fitness being the baseline), but the same dynamic crops up in neuroscience due to biophysical computational efficiencies from relative heuristics as opposed to a laundry list of absolute fixed preferences. R. A. Fisher famously wished to lay the seedbed for a thermodynamics of evolution in The Genetical Theory of Natural Selection. Whether one can envisage this in evolutionary genetics, it seems even less likely in the human sciences, at least to the extent of making a generalization which is not trivial. The rut which orthodox evolutionary psychology has found itself in is probably due to this assumption that our species is at some biobehavioral equilibrium due to an exceedingly unrealistic model of evolutionary dynamics.

Labels: Behavior Genetics, Behavioral Economics, Economics

Tuesday, July 07, 2009

Anti-Irish caricatures, the hypothesis that some races contain little intra-race variation, and how economists keep arguing--normatively and positively--for the rough equality of humankind: It's all in Peart and Levy's book The Vanity of the Philosopher.

The book is highly recommended to GNXPers with any interest in the complicated historical relationship between genetics and social science. The major value-added comes from the oft-ignored tension between economic theorists and evolutionary theorists. Well, that and the cartoons. The book builds on Levy's earlier work How the Dismal Science Got its Name. A free, abbreviated version of that story is here, and is wiki'd here. For some HBD newbies, the best part of Vanity will be the discussion of the Irish: In the early days of Darwinism, the people of the Emerald Isle were Exhibit A (or B) of an inferior race. Peart and Levy have a great discussion of how 19th century intellectuals hoped the Irish to evolve to become as well-mannered as, say, the English. And in the 19th century, whenever attacks on the Irish started up, attacks on abstract, unrealistic, ahistorical economic theory were rarely far behind. Funny, that... Oh, one more reason to take a look at Vanity: Peart and Levy slide the knife into Charles Dickens, a sight always to be relished. Labels: Economics

Friday, July 03, 2009

I was listening to Marketplace the other day and Kevin Hassett delivered a commentary combining economics with a revisionist evaluation of the American Revolution. Hassett's argument seems to be that the Revolution, which was notionally predicated on taxation without representation, will in the long run be a historical blip of no consequence as the United States converges upon the same tax and spend structure as the United Kingdom. From this convergence of tax and expenditure structures Hassett infers an eventual closing of the $10,000 GDP per capita gap between the United States and the United Kingdom. What therefore was the point of breaking away if 200 years later the USA is going to be so similar to the United Kingdom?

There are many ways to critique this sort of analysis, but there are two major issues that I jumped out for me. First, 200 years is not a trivial interval of time, especially when taking into account the large numbers of Americans who lived between then and now. To view economic history as convergence toward equilibria as a few parameters are modulated at some point in the future seems worthless, just as pointing out that the Sun will go nova, or that the universe may be doomed to heat death. There is a big difference between asserting that the GDP per capita gap will close within 10 years, and within 100 years. Tractable and elegant macroeconomic models may be mostly junk over the short term, but I'm pretty sure that they're total junk over the long term. Inferences from stylized facts may provoke, but spare me the assumption that that the error bars of projections aren't so huge as to make them useless even for government work. Second, it isn't as if the only things that separate the United States and the United Kingdom are institutional frameworks. Even within the United States there is quite a bit of regional variation in culture. Perhaps Hassett would say that specific variation in the instantiation of human capital is totally irrelevant, but most people wouldn't assume that as a given. Secondarily there is a sense here that historical contingency doesn't exist, that there is no path dependence in economic development. So the 200 year interval whereby the American Revolution served as an exogenous shock which tore the thirteen colonies out of the British Empire had no significant effect by shifting initial parameters in a manner which might "lock in" a bias toward some developmental paths as opposed to others. But evaluated over a long enough interval all historical events can be marginalized as futile acts against the trendline, whatever it is. Instead of using an abstract framework riddled with assumptions that many people would find laughable, why not go the route of pointing to the nature of the British settler colonies which did not revolt, but eventually became independent? Obviously Australia, Canada and New Zealand are different in myriad ways from the United States, but are the comparisons more strained than the model that Hassett posits?

Thursday, July 02, 2009

In the new issue of The New Yorker, Malcolm Gladwell reviews some book about using the appeal of FREE to grow your business. This is supposed to apply most strongly to information, so that as more and more of a firm's product / service consists of information, the more it can use the appeal of FREE to earn money.

What both Gladwell and the reviewed book's author, Chris Anderson, don't seem to realize is that the appeal of FREE creates pathological behavior. Gladwell even cites a revealing behavioral economics experiment by Dan Ariely: Ariely offered a group of subjects a choice between two kinds of chocolate -- Hershey's Kisses, for one cent, and Lindt truffles, for fifteen cents. Three-quarters of the subjects chose the truffles. Then he redid the experiment, reducing the price of both chocolates by one cent. The Kisses were now free. What happened? The order of preference was reversed. Sixty-nine per cent of the subjects chose the Kisses. The price difference between the two chocolates was exactly the same, but that magic word "free" has the power to create a consumer stampede. In other words, FREE caused people to choose an inferior product more than they would have if the prices were both positive. Thus, in a world where there is more FREE stuff, the quality of stuff will decline. It's hard to believe that this needs to be pointed out. And again, this is not the same as prices declining because technology has become more efficient -- prices are still above 0 in that case. FREE lives in a world of its own. If you're only trying to get people to buy your target product by packaging it with a FREE trinket, then that's fine. You're still selling something, but just drawing the customer in with FREE stuff. This jibes with another behavioral economics finding -- that when two items A and B are similar to each other but very different from item C, all lying on the same utility curve, people ignore C because it's hard to compare it to the altneratives. They end up hyper-comparing A and B since their features are so similar, and whichever one is marginally better wins. So if you have three more or less equally useful products, A B and C, where B is essentially what A is, just with something FREE thrown in, people find it a no-brainer to choose B. An exception to the rule of "FREE leads to lower quality" might be the products that result from dick-swinging competitions, where the producer will churn out lots of FREE stuff just to show how great they are at what they do. They're concerned more with reputation than getting by. Academic work could be an example -- lots of nerds post and critique scientific work at arXiv, PLoS, as well as the more quantitatively oriented blogs. But in general, you can imagine the quality level you'd enjoy from a free car or an all-volunteer police force. Even sticking with just information, per Chris Anderson, look at what movies you can download without cost on a peer-to-peer site or whatever -- they mostly all suck, being limited to the library of DVDs that geeks own. Sign up for NetFlix or a similar service, and you have access to a superior library of movies, and it hardly costs you anything -- it's just not FREE. Ditto for music files you can download cost-free from a P2P site vs. iTunes, or even buying the actual CD used from Amazon or eBay. Admittedly I don't know much about computer security, but just by extending the analogy of a voluntary police force, I'd wager that security software that costs anything is better than FREE or open source security software. To summarize, though, Gladwell's discussion about FREE misses the most important part -- it tends to lower quality. I don't want to live in a word of lower quality of items that aren't of major consequence, and (hopefully) the people in charge of high-consequence items like the police and my workplace's computer security will never be persuaded to go for FREE crap in the first place. This aspect alone answers the question he poses in the sub-headline, "Is free the future?" However, wrapping your brain around the idea that FREE tends to lower quality is discordant with a Progressive worldview, which explains why Gladwell just doesn't get it. Labels: Behavioral Economics, Economics, Media, Technology

Thursday, June 25, 2009

Updated

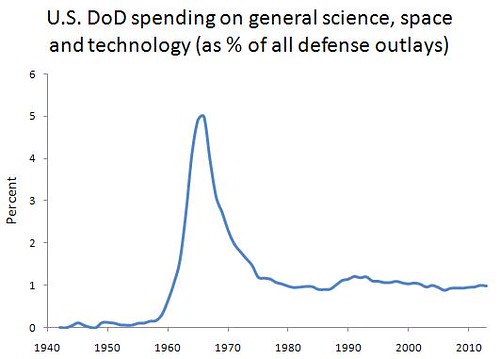

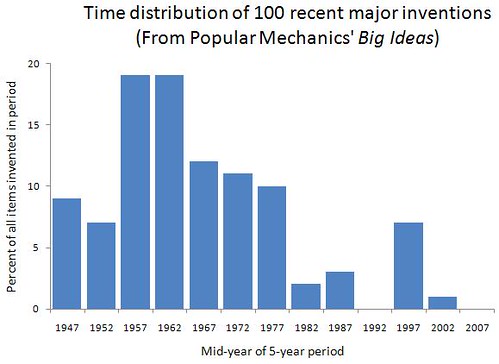

This may be old hat for some readers, but it's worth reviewing and providing some good new data for. The motivation is the idea that monopoly-haters have that when some company comes to dominate the market, they will have no incentive to change things -- after all, they've already captured most of the audience. The response is that industries where invention is part of the companies' raison d'etre attract dynamic people, including the executives. And such people do not rest on their laurels once they're free from competition -- on the contrary, they exclaim, "FINALLY, we can breathe free and get around to all those weird projects we'd thought of, and not have to pander to the lowest common denominator just to stay afloat!" Of course, only some of those high-risk projects will become the next big thing, but a large number of trials is required to find highly improbable things. When companies are fighting each other tooth-and-nail, a single bad decision could sink them for good, which makes companies in highly competitive situations much more risk-averse. Conversely, when you control the market, you can make all sorts of investments that go nowhere and still survive -- and it is this large number of attempts that boosts the expected number of successes. With that said, let's review just a little bit of history impressionistically, and then turn to a new dataset that confirms the qualitative picture. Taking only a whirlwind tour through the pre-Information Age time period, we'll just note that most major inventions could not have been born if the inventor had not been protected from competitive market forces -- usually from protection by a monopolistic and rich political entity. Royal patronage is one example. And before the education bubble, there weren't very many large research universitities in your country where you could carry out research -- for example, Oxford, Cambridge, and... well, that's about it, stretching back 900 years. They don't call it "the Ivory Tower" for nothing. Looking a bit more at recent history, which is most relevant to any present debate we may have about the pros and cons of monopolies, just check out the Wikipedia article on Bell Labs, the research giant of AT&T that many considered the true Ivory Tower during its hey-day from roughly the 1940s through the early 1980s. From theoretical milestones such as the invention of information theory and cryptography, to concrete things like transistors, lasers, and cell phones, they invented the bulk of all the really cool shit since WWII. They were sued for antitrust violations in 1974, lost in 1982, and were broken up by 1984 or '85. Notice that since then, not much has come out -- not just from Bell Labs, but at all. The same holds true for the Department of Defense, which invented the modern airliner and the internet, although they made large theoretical contributions too. For instance, the groundwork for information criteria -- one of the biggest ideas to arise in modern statistics, which tries to measure the discrepancy between our scientific models and reality -- was laid by two mathematicians working for the National Security Agency (Kullback and Leibler). And despite all the crowing you hear about the Military-Industrial Complex, only a pathetic amount actually goes to defense (which includes R&D) -- most goes to human resources, AKA bureaucracy. Moreover, this trend goes back at least to the late 1960s. Here is a graph of how much of the defense outlays go to defense vs. human resources (from here, Table 3.1; 2008 and beyond are estimates):  There are artificial peaks during WWII and the Korean War, although it doesn't decay very much during the 1950s and '60s, the height of the Cold War and Vietnam War. Since roughly 1968, though, the chunk going to actual defense has plummeted pretty steadily. This downsizing of the state began long before Thatcher and Reagan were elected -- apparently, they were jumping on a bandwagon that had already gained plenty of momentum. The key point is that the state began to give up its quasi-monopolistic role in doling out R&D dollars. Update: I forgot! There is a finer-grained category called "General science, space, and technology," which is probably the R&D that we care most about for the present purposes. Here is a graph of the percent of all Defense outlays that went to this category:  This picture is even clearer than that of overall defense spending. There's a surge from the late 1950s up to 1966, a sharp drop until 1975, and a fairly steady level from then until now. This doesn't alter the picture much, but removes some of the non-science-related noise from the signal. [End of update] Putting together these two major sources of innovation -- Bell Labs and the U.S. Defense Department -- if our hypothesis is right, we should expect lots of major inventions during the 1950s and '60s, even a decent amount during the 1940s and the 1970s, but virtually squat from the mid-1980s to the present. This reflects the time periods when they were more monopolistic vs. heavily downsized. What data can we use to test this? Popular Mechanics just released a neat little book called Big Ideas: 100 Modern Inventions That Have Changed Our World. They include roughly 10 items in each of 10 categories: computers, leisure, communication, biology, convenience, medicine, transportation, building / manufacturing, household, and scientific research. They were arrived at by a group of around 20 people working at museums and universities. You can always quibble with these lists, but the really obvious entries are unlikely to get left out. There is no larger commentary in the book -- just a narrow description of how each invention came to be -- so it was not conceived with any particular hypothesis about invention in mind. They begin with the transistor in 1947 and go up to the present. Pooling inventions across all categories, here is a graph of when these 100 big ideas were invented (using 5-year intervals):  What do you know? It's exactly what we'd expected. The only outliers are the late-1990s data-points. But most of these seemed to be to reflect the authors' grasping at straws to find anything in the past quarter-century worth mentioning. For example, they already included Sony's Walkman (1979), but they also included the MP3 player (late 1990s) -- leaving out Sony's Discman (1984), an earlier portable player of digitally stored music. And remember, each category only gets about 10 entries to cover 60 years. Also, portable e-mail gets an entry, even though they already include "regular" e-mail. And I don't know what Prozac (1995) is doing in the list of breakthroughs in medicine. Plus they included the hybrid electric car (1997) -- it's not even fully electric! Still, some of the recent ones are deserved, such as cloning a sheep and sequencing the human genome. Overall, though, the pattern is pretty clear -- we haven't invented jackshit for the past 30 years. With the two main monopolistic Ivory Towers torn down -- one private and one public -- it's no surprise to see innovation at a historic low. Indeed, the last entries in the building / manufacturing and household categories date back to 1969 and 1974, respectively. On the plus side, Microsoft and Google are pretty monopolistic, and they've been delivering cool new stuff at low cost (often for free -- and good free, not "home brew" free). But they're nowhere near as large as Bell Labs or the DoD was back in the good ol' days. I'm sure that once our elected leaders reflect on the reality of invention, they'll do the right thing and pump more funds into ballooning the state, as well as encouraging Microsoft, Google, and Verizon to merge into the next incarnation of monopoly-era AT&T. Maybe then we'll get those fly-to-the-moon cars that we've been expecting for so long. I mean goddamn, it's almost 2015 and we still don't have a hoverboard. Labels: Economics, History, politics, Technology

Sunday, May 10, 2009

A Genetically Mediated Bias in Decision Making Driven by Failure of Amygdala Control: